Stock option tax calculator

In our continuing example your theoretical gain is. Explore the LiveVol analytics platform with a free 15-day trial.

U9f7vmjpnzvc8m

What will my restricted stock or restricted stock.

. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. If youre a startup employee earning stock options its important to understand how your stock. Ad Trade your view on equity volatility with VIX options and futures.

Attend an upcoming free tutorial. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. The tool will estimate how much tax youll pay plus your total return on your non.

While if you hold that property or stock. Receiving options for your companys stock can be an incredible benefit. Sign up for the latest on how to invest in Nasdaq-100 Index Options.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. For example a 30-day option on stock ABC with a 40. Ad We Alert Our Members To The Biggest Stock Moves Every Day Before They Occur.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Full Access To The Most Exclusive Algorithmic Trading System Publicly Available. New Hampshire doesnt tax income but does tax dividends and interest.

Ordinary income tax and capital gains tax. Quick-Take Calculator for Restricted Stock. Made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice.

We cannot and do. The following calculator enables workers to see what their stock options are likely to be valued at for a. The Employee Stock Options Calculator.

If My Restricted Stock Vested Today How Much Money or How Many Shares Would I Have. New Look At Your Financial Strategy. Nonqualified Stock Option NSO Tax Calculator.

When cashing in your stock options how much tax is to be withheld and what is my actual. The Stock Option Plan specifies the total number of shares in the option pool. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

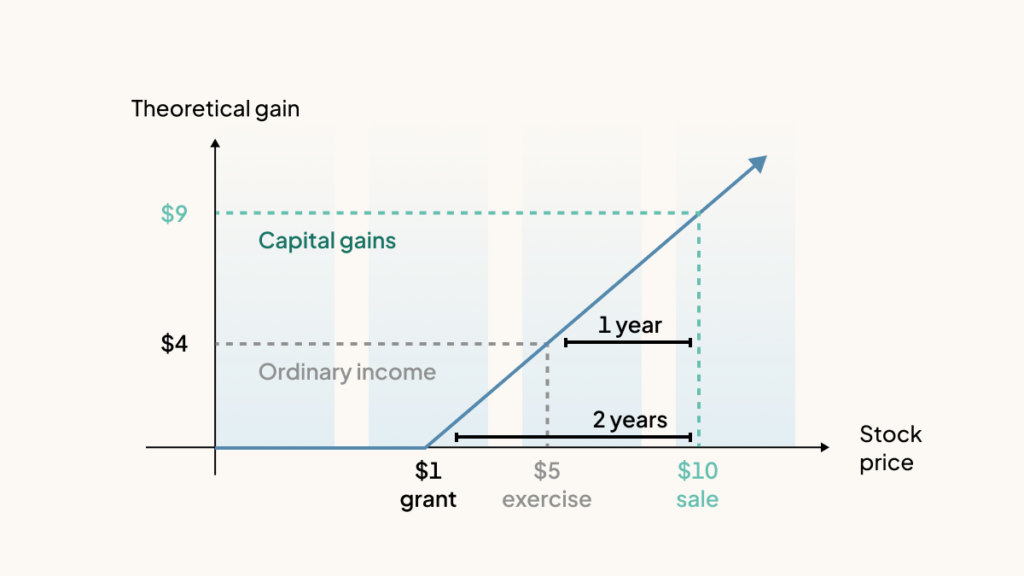

On this page is a non-qualified stock option or NSO calculator. The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income. Nonqualified Stock Options NSOs are common at both start-ups and well established companies.

Ad Explore the LiveVol options analytics platform. The Stock Option Plan specifies the total number of shares in the option pool. Short-term and long-term capital gains tax.

Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. For use with Non-Qualified Stock Option Plans. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

On this page is an Incentive Stock Options or ISO calculator. There are two types of taxes you need to keep in mind when exercising options. Stock Option Calculator Canadian.

Use this calculator to. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant. The complete guide to employee stock option taxes.

You will only need to pay the greater of. Visit The Official Edward Jones Site. Even after a few years of moderate growth stock options can produce a handsome return.

From January 1 1971 to December 31 st 2020 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 108 source. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Employee Stock Option Calculator for Startups Established Companies.

The calculator eases the complexity of the calculation by providing you with the option of factoring in the values of commission in percentage or amount.

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

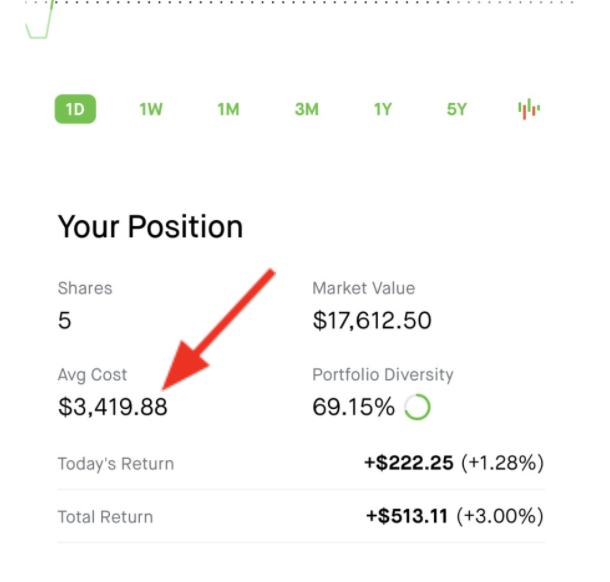

Average Cost Robinhood

Capital Gains Tax What Is It When Do You Pay It

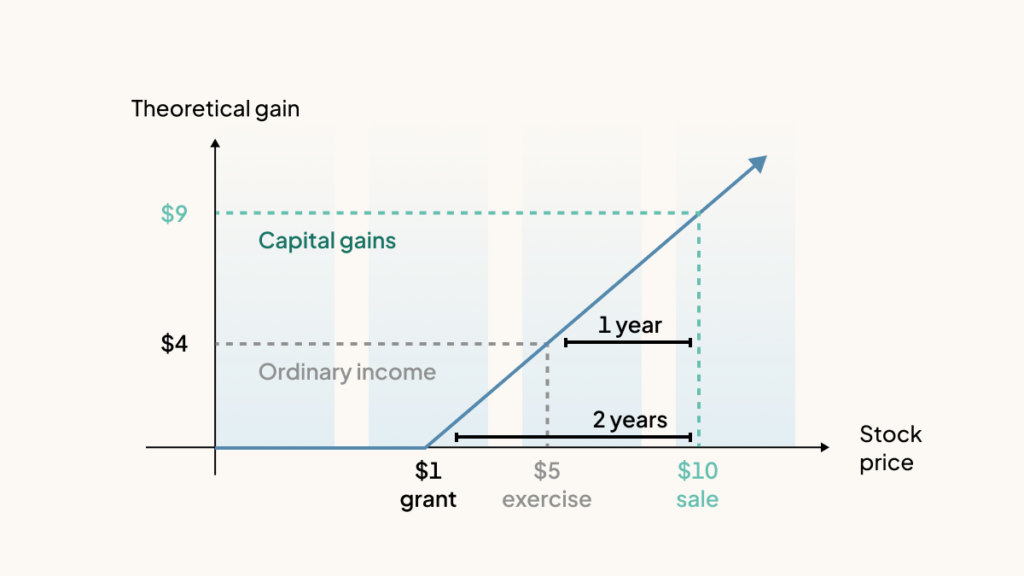

How Stock Options Are Taxed Carta

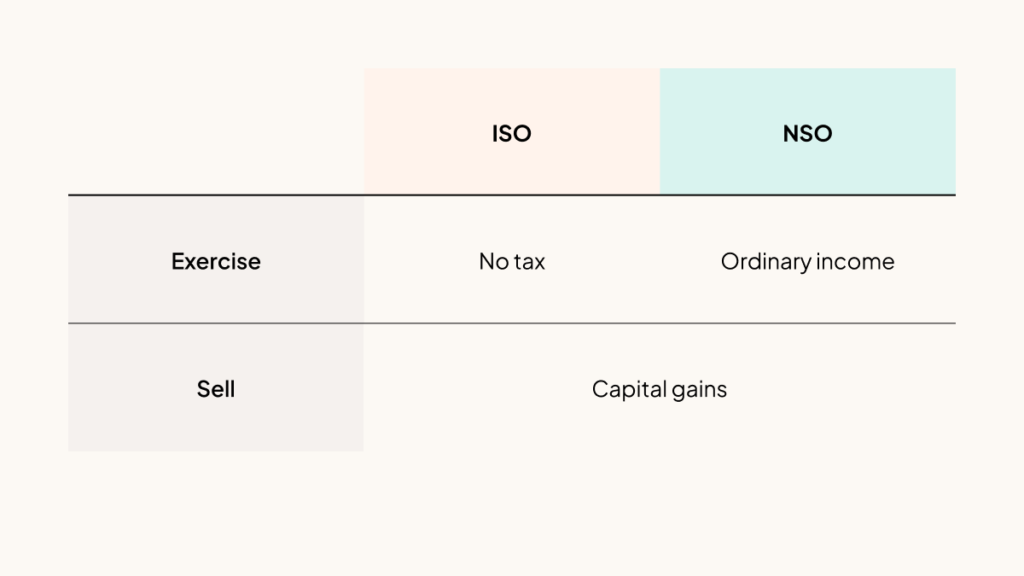

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

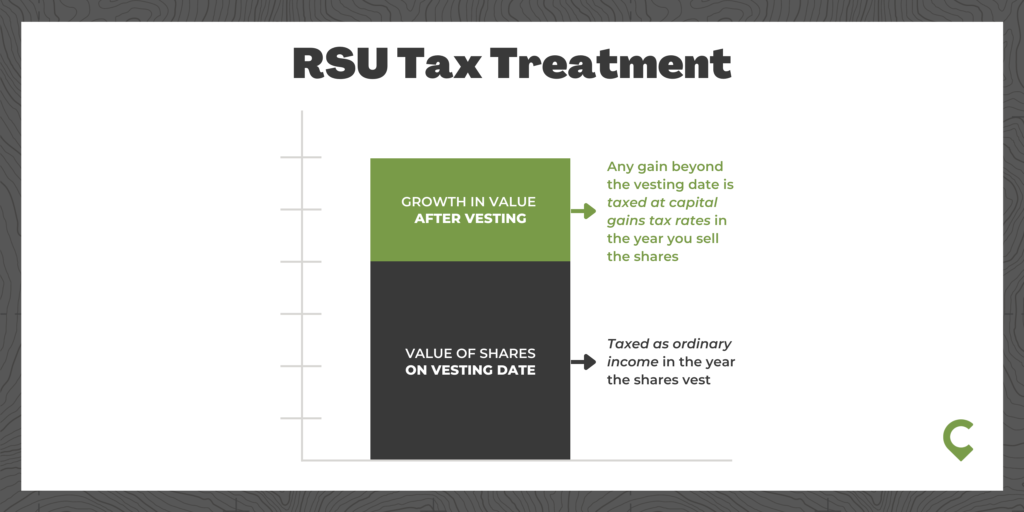

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Understanding How The Stock Options Tax Works Smartasset

Understanding How The Stock Options Tax Works Smartasset

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

What Is An Employee Stock Option Eso

Employee Stock Options Financial Edge

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

How Stock Options Are Taxed Carta

Tkngbadh0nkfnm

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe